Exactly the same reporting and distribution needs utilize into a Gold centered IRA account, concerning a daily common IRA. Having said that, the metals have to be from the possession of a trustee or custodian.

Sustaining independence and editorial independence is critical to our mission of empowering investor achievement. We provide a platform for our authors to report on investments pretty, accurately, and within the investor’s point of view. We also respect particular person opinions––they symbolize the unvarnished thinking of our people today and exacting Evaluation of our study procedures.

American Hartford Gold delivers good customer support but has had essentially the most complaints from any in the companies we reviewed.

To locate the greatest gold IRAs of 2024, we reviewed more than 20 firms on the services they supply, their account minimums and their service fees. From that list, we narrowed the choice to 7 companies that characterize the most beneficial the field has to offer.

Facts As its title indicates, Silver Gold Bull specializes in gold and silver investments, and also offers a modest array of other precious metal assets like platinum coins and collectibles in other metals. Silver Gold Bull has long been in business since 2006.

Furthermore, it stands out for giving new customers a beneficial welcome reward. Having said that, it lacks a little bit in its academic resources when compared to other offered options.

Gold IRA Companies does attempt to take an inexpensive and great faith method of protecting objectivity to providing referrals which have been in the very best interest of readers. Gold IRA Companies strives to keep its information accurate and up to date. The knowledge on Gold IRA Companies may be distinctive from what you discover when visiting a 3rd-party Internet site. All products and find more solutions are introduced without guarantee. To find out more, you should browse our entire disclaimer.

Standout Gains: Rosland Cash meets the highest criteria set from the BBB and BCA and presents distinct storage options for your gold, with each IRA-holder's gold retained in separate, safe storage.

Our authors can publish views that we might or might not agree with, Nevertheless they show their work, distinguish facts from opinions, and ensure their Investigation is clear and on no account misleading or misleading. To more defend the integrity of our editorial written content, we keep a strict separation involving our profits teams and authors to eliminate any force or influence on our analyses and analysis. Browse our editorial plan to learn more about our course of action.

Defend on your own from inflation: Gold is often accustomed to hedge from inflation for a number of reasons, including its common recognition and the inability for being devalued by printing.

The two of such IRA options let you put money into gold together with other metals, but just not physically. It is possible to spend money on gold stocks and ETFs in addition to the stocks of gold mining or processing companies.

By allocating a part of their financial savings to precious metals via a Gold IRA, investors can lower exposure to market place downturns. This diversification strategy is especially attractive during moments when the inventory market experiences sharp corrections or extended downturns.

There are some other very common varieties of IRAs, the most common remaining a conventional IRA or even a Roth IRA. While they won't let you specifically invest in physical precious metals, determined by your needs, they may do the job at the same time.

It's also imperative that you consider your targets for this investment. Are you currently in search of lengthy-time period development, or are you aiming for short-time period balance from fluctuating marketplaces? This may not simply effects your selection on simply how much you will be planning to spend, but exactly where and That which you're investing in also.

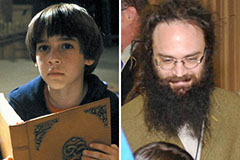

Barret Oliver Then & Now!

Barret Oliver Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!